Finding the ICP (Ideal Customer Profile)

how to build and nurture your ideal customer profile in B2B sales

In 2022, Norway exported more than 1.25 million tons of salmon, essentially becoming the world's leading exporter. This isn't new; already in 1980, more than half of the farmed salmon you could find for sale came from Norway.

Starting from the 1980s, Norwegian salmon production began to grow exponentially, to the point where supply far exceeded demand.

Compared to a company, the Norwegian state found itself with an appreciated product that it was producing in quantities greater than those required and consequently couldn't sell all of it.

So what to do? New customers are needed, the sales target needs to be expanded. And here comes the stroke of genius. The Norwegians look at each other and say: let's create new demand where nothing exists today, let's sell more salmon to the Japanese who will then use it to make sushi.

It all seems crazy, but in 1986 the Norwegian Ministry of Fisheries inaugurated the "Japan Project," soon convincing a Japanese frozen food company to buy 5,000 tons of raw salmon to be used exclusively for sushi.

Although today it's perfectly normal to associate salmon with sushi, before then it wasn't so, and in Japan, sushi wasn't prepared with this type of fish. It was the beginning of a new era: from the 2 tons of salmon exported from Norway to Japan in 1980, it rose to 28,000 tons in 1995.

What is an ideal customer profile

The incredible story of Norwegian salmon, the result of ingenuity, diplomacy, marketing, and storytelling, is the starting point to begin talking to you about the Ideal Customer Profile, also known as ICP.

Borrowing the words of Stijn Hendrikse and Mike Northfield from the book T2D3: How some software startups scale, where many fail:

"An ICP (Marketing) is an outline of your ideal customer: the ones you want more of. The ones who buy from you consistently and tell others about their experiences. The customers that do not churn. The customers that had a real pain problem and clearly embraced your value proposition. The customers that had the shortest sales cycles and lowest sales friction."

In far fewer words, ICP Sales and ICP Marketing define a hypothetical company or organization that represents the perfect customer for the product or service being sold.

The Norway example is obviously outside traditional schemes, but it gives a good idea of how the search for an ICP is something very versatile and dynamic. In their case, the Scandinavian country already had a highly appreciated product, a well-known product, well-positioned in the food market and in the minds of consumers. The Ideal Customer Profile was therefore clear and solid (the various companies to which to sell salmon), but it was no longer enough, the context had changed and the ICP also required renewal. Hence the study of new useful market segments and the definition of a new target audience.

The new ICP of the Norwegian Ministry of Fisheries not only identified a huge number of new ideal customers, creating from scratch a need that until recently did not exist, but gave birth to a true lovemark: sushi prepared with salmon.

How to identify your Ideal Customer Profile ICP

Even if the Norwegian state is not exactly a company, its behavior demonstrates all the power and effectiveness of an ICP conceived correctly. The goal is very simple: sell your products and do it to the right customers.

The ICP is therefore among the main elements that drive a company's growth, as well as its sales and marketing strategies. But where do you start to create one? What are the components to analyze, the right questions to ask, and the various requirements to meet?

I will continue by examining all these points to give you the opportunity to have a well-traced perimeter where you can best orient yourself in defining an Ideal Customer Profile. There are 5 phases to elaborate:

Research and understanding of the market in which you operate

Segmentation

Definition of the ICP and buyer personas

Testing and refinement

Implementation of the ICP in the GTM strategy and continuous monitoring

First phase: research and understanding of the market in which you operate

The first phase in defining an ICP is research and understanding of the market in which a company operates. This is articulated in 3 steps:

Market analysis

The company must understand where it is, what its playing field is, and what characteristics will then be crucial for selling its products or services.

To do this, you need to study the main industry trends, focus on the most profitable segments in terms of demand, and shed light on the factors that influence market dynamics: logistics, regulatory context, level of competition, and entry barriers.

Competitor analysis

Who are the competitors? What are their strengths and weaknesses? What is their positioning and how do they differentiate their products on the market? What are their pricing strategies and what are the empty spaces to fill?

By analyzing the competition, every company should be able to answer all these questions, obtaining useful information to identify those distinctive elements to bring out during the go-to-market.

Pain points and needs

What kind of needs do customers have when looking for a product or service present in a certain market? What problems are they trying to solve?

To answer these questions, a large amount of information needs to be collected. The collection methods can be different: qualitative and quantitative surveys, focus groups to deepen the challenges, needs, and preferences that emerged in the surveys, analysis of customer feedback, their reviews, and comments left on social media to identify areas for improvement.

Second phase: segmentation

All the information collected in phase 1 should be used to arrive at the most promising market segments, where to concentrate efforts.

Segmenting in this case means dividing the reference market into smaller categories, defined based on common characteristics. In this way, it will be possible to focus on those groups of prospects that would obtain more advantages using a particular product or service.

Even if it may initially seem counterintuitive (why not aim directly at everyone!?), the smaller the reference market, the faster prospects will be reached and the higher the conversion rates will be. There's always time to expand and broaden your sales pool.

The criteria for segmenting a given market can be different:

Demographics (age, gender, income level, education, occupation)

Geographic (location, region, city, specific neighborhoods)

Psychographic (lifestyles, interests, values, attitudes, and personality traits)

Behavioral (purchasing habits, brand interactions, product use, loyalty)

The next step is to evaluate the potential of each segment in relation to the product/service sold. To do this, you need to know:

How attractive a segment is, based on growth potential, accessibility, size, and fruitfulness.

How much the needs and expectations contained in each segment correspond to the offer of products or services sold.

How much competition is present in individual segments.

How much the company is able to serve and preside over each segment, deriving maximum profit from it.

The last step is to prioritize the various segments based on the collected data, in order to aim at those that align most with the company's objectives and capabilities. In other words, you need to make a ranking: what is the top 5 of the segments you have identified? are they really all useful to your business? will they help you equally to achieve positive results?

Third phase: definition of the ICP and buyer personas

After identifying and prioritizing the most promising market segments for your business, an ideal profile, a target reference, must be connected to each segment.

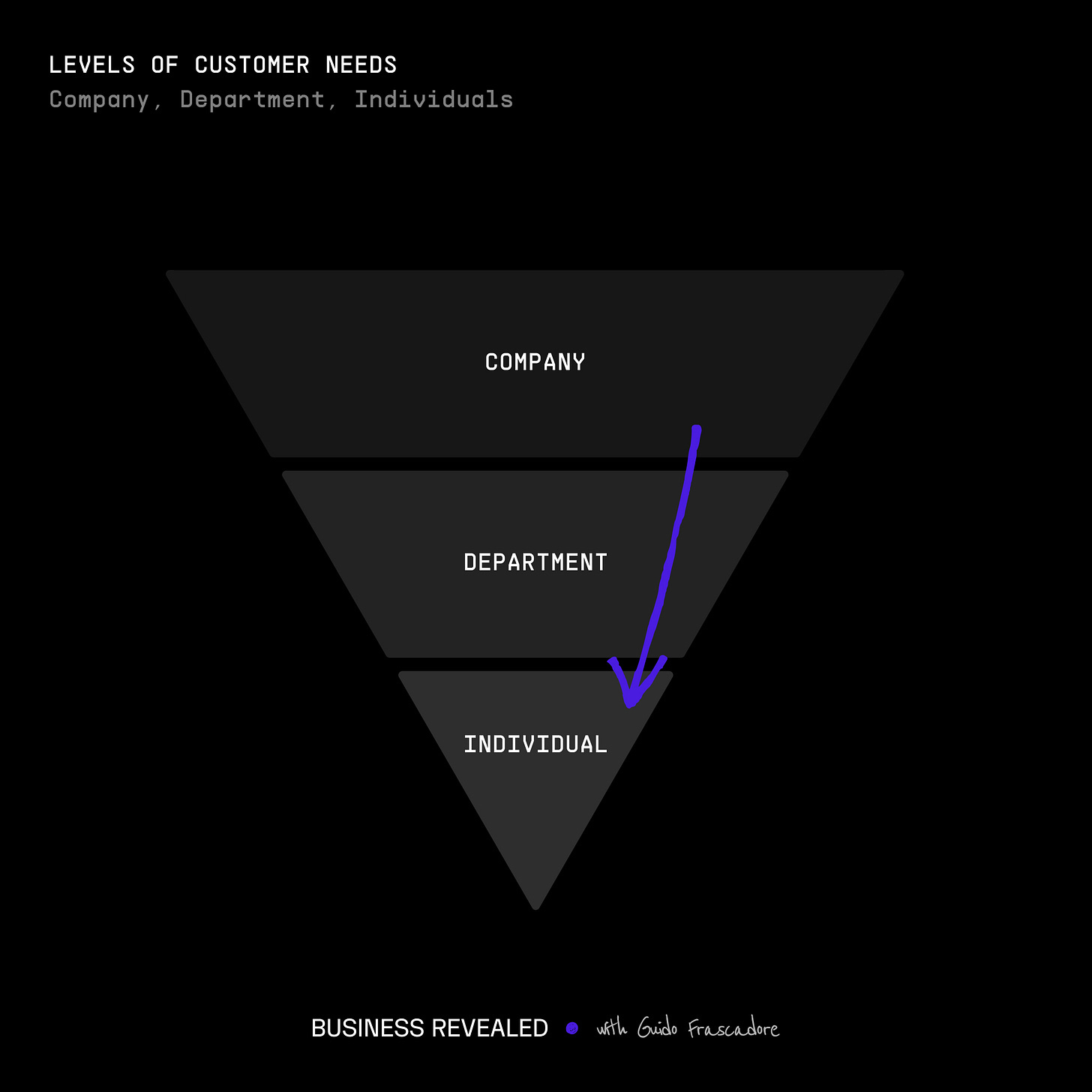

To do this, a series of information is needed that will later be used by sales and marketing teams to work on customer engagement and understand how much the acquired customers are actually in line with the criteria established by the ICP. The main elements are:

Company size: total number of employees, number of employees per single department, annual revenue (LinkedIn is a great starting point to start this type of research, alternatively I recommend PhantomBuster).

Industry type: in what market do the companies that fall within the ICP operate? Are they fintech? Do they belong to the pharma sector? Do they make software?

Company age: it's very important to know how many years a potential client company has existed, more mature companies are for example much less prone than startups to take risks.

Demographic information: average age of employees, gender, income level, education, and professional qualification.

Geographic information: location of the company headquarters, the geographical area in which the potential customer operates, climatic factors that could affect logistics.

Technographics: what are the technological solutions and tools used by the company to manage work flows in the various departments? (HubSpot, SAP, Oracle, Trello, Slack, Microsoft Azure, Marketo, Power BI, Visual StudioCode)

Psychographic data: interests, hobbies, and values of the customer that could influence the perception of the product for sale.

Behavioral data: purchasing habits, usage patterns of the product for sale, and interactions with the brand.

Needs and pain: specific challenges or problems that a product or service can solve for the customer.

Decision triggers: events or circumstances that push the customer to look for the proposed solutions.

The more details that emerge from this analysis, the more detailed the target will be, the more it will be possible to understand the characteristics, needs, and behaviors of the ideal customer.

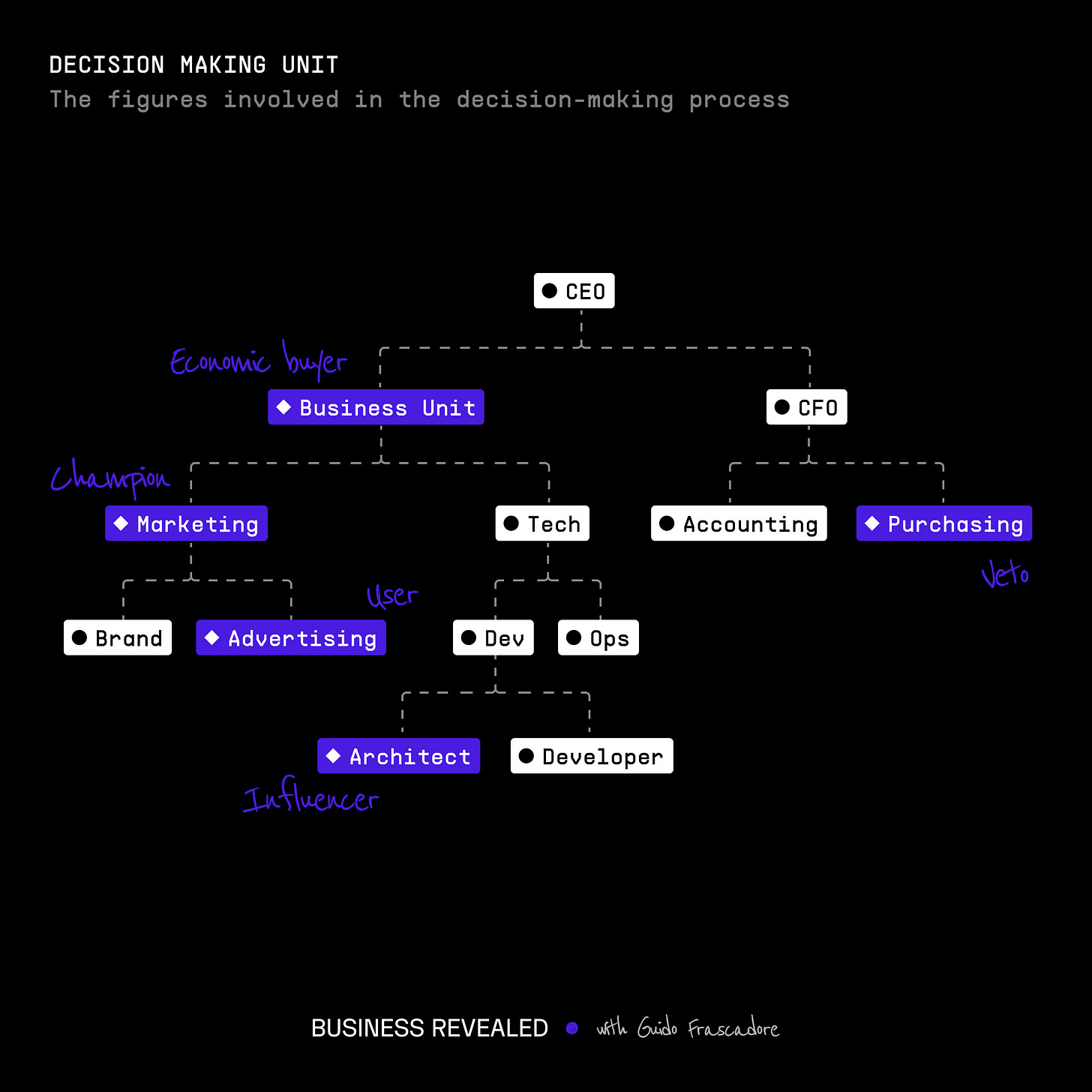

The figures involved in the decision-making process

Once the ideal target has been identified, it's time to discover who will be the ideal profiles of the people who are responsible for purchasing within a company, the so-called buyer personas. But first, a premise on the sales process between companies (B2B) is necessary.

Unlike B2C sales, companies are not comparable to a human being, it's not the company that decides to buy a product or service, but the people who work within it. And these people may have conflicting interests and perspectives regarding the same product.

Within each company, there will therefore be several figures who play a key role in the decision-making process. The goal is to understand who these people are and how to engage them.

The key figures that drive the decision-making process on the purchase of a new product or service are three:

The end users - All those people who will directly use a product or service in their daily work.

The champion - The figure who actively promotes the purchase of the product or service by the company.

The economic buyer - The person responsible for the budget necessary to purchase the product or service.

These three roles are present in all companies, in smaller ones the figures might overlap, but basically it's always necessary to investigate starting from these figures.

But where to start the search? There is no written manual, but the tools available today are undoubtedly many more than in the past. Platforms like LinkedIn or similar allow you to obtain information about a company's employees more easily, some companies even provide contacts for the main executive figures on their website pages. There are also several lead generation platforms (Apollo, Lusha) that provide hundreds and hundreds of data to support sales.

The champion is ideally the figure from which to start the search, being the person who will then have to promote the purchase of a product among the company's departments. But things are not always that easy, sometimes it's not simple to find and contact the champion.

In these cases, the only thing to do is to find at least one internal contact in the company, a phone number, an email, a social profile, any means that allows you to get in touch with the potential customer.

Once the contact is obtained, the goal is to extract precious information that leads to the champion or at least to the end user of that company. Usually in these cases, we proceed with the so-called discovery questions, those questions that allow you to verify if the intercepted prospect and its attributes are actually in line with the ICP.

To make the most of the time of the first contact, it's important to set up questions that aim to establish the problems of potential buyers, the impact these problems have on their working life, and the critical events that are causing the problem. Without this information, it will be very difficult to get to the heart of the sale.

Other important figures

Alongside the figures just seen, there are other roles that can influence the sales process.

Influencers: these are people who manage to influence the decisions of the main decision-makers thanks to their experience or their company position. These figures can also be external, such as newspapers, industrial groups, or consulting companies.

Stakeholders with veto power: in many companies, there are figures who, based on hierarchies or the functions they perform, may have the power to block a certain purchase. For example, the IT department could veto the purchase of software.

Purchasing department: those who work in the purchasing department deal with the management of the entire purchasing process and, as often happens, aim to reduce costs, of any nature. It's not a team present in all companies, it depends on the size, but it could slow down the sale or in any case orient the choice towards less expensive competitors (it's not uncommon for a purchasing department to ask for more quotes to compare on the same product/service).

Attributes of buyer personas

Returning to buyer personas and taking into account the main company figures involved in the decision-making process, the key aspects to investigate to define the ideal profile of a buyer persona are:

Role: what role does the buyer persona profile have in the sale? Is it an end user? Is it the economic buyer? Is it the champion?

Job titles: the possible job titles of stakeholders in their respective roles.

Pain points: the common challenges that each role has in solving a particular problem with the solutions at their disposal (if present). Keep in mind that in this case the challenges could vary depending on the role: for a UI designer, a tool like Adobe Sensei could simplify and speed up the less creative tasks of their work, while for the Design manager it would mean having more time to plan future strategies with his team to improve the product/service sold. Similarly, not always are buyer personas looking to solve their pain points: there will be those who are actively looking to solve certain problems, those who don't recognize the problem as a problem, those who try to solve it with DIY methods, and those who are aware of the problem but are not motivated or interested in solving it.

Desired impact: the results that each role expects using the product or service to be purchased. Also in this case there are differences between the various roles: usually the end user wants to obtain an improvement in their working life (reduce repetitive work, save time, reduce stress), the economic buyer will instead be interested in the impact that new solutions will have on company objectives (reduce costs, increase sales).

Critical events: imminent projects or activities within the company that make a change urgent and that could consequently influence the final choice of the buyer.

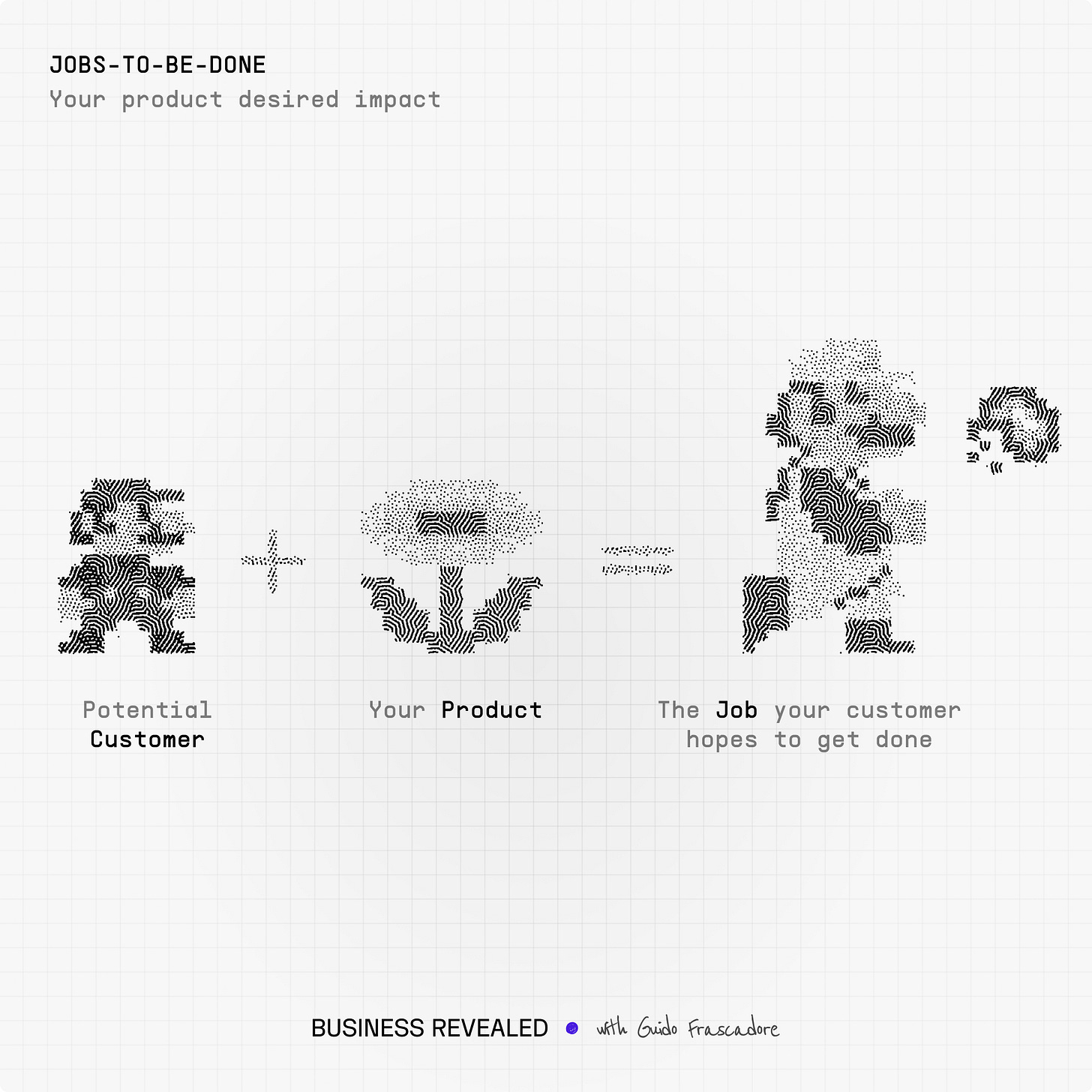

Use of Jobs-to-be-Done (JTBD)

The Jobs-to-be-Done (JTBD) framework can be particularly useful in tracing pain points and desired impacts related to buyer personas. Here's how JTBD can enhance our understanding:

Identifying underlying needs: JTBD helps uncover the fundamental "job" a persona is trying to accomplish, which can reveal pain points that may not be immediately obvious when focusing solely on product features or roles.

Contextualizing activities: By understanding the "job" a persona is trying to get done, we can better contextualize their activities and understand why certain tasks are important to them.

Uncovering emotional aspects: JTBD considers both functional and emotional aspects of a job, helping to identify pain points related to frustration, stress, or other emotional factors that might not be captured in a traditional persona description.

Mapping the customer journey: JTBD can help map out the entire process a persona goes through to complete a job, highlighting pain points and activities at each stage.

Prioritizing pain points: By understanding which "jobs" are most critical to a persona, we can better prioritize which pain points to address first in product development or marketing strategies.

Integrating JTBD with buyer personas provides a more comprehensive view of customer needs and behaviors, allowing for more effective targeting of pain points and optimization of key activities in the customer journey.

If you're working on your ICP and need help synthesizing all these attributes, you can download my ideal customer profile worksheet. It will help you group the various information collected.

Fourth phase: testing and refinement

The fourth phase potentially knows no end. Once the ICP and its buyer personas have been defined, the time for tests, the validation phase, and any refinements arrives. But this flow is not limited to the first developments or the subsequent implementation of the ICP in the GTM strategy.

The process is a continuous process, a loop of feedback and adjustments that allows companies to always work in perfect sync with what are the changes in the market and their ideal customers.

In this phase, there are several activities that can be undertaken: testing the various sales messages and the channels from which they are conveyed, collecting customer feedback (surveys, interviews), collecting quantitative data following marketing activities (conversion rate, engagement rate), updating the ICP and buyer personas based on the new information collected (refining demographic, psychographic data, pain and needs, etc.), readapting marketing strategies and the choice of channels used to reach customers.

Only in this way will it be possible to ensure that the ICP always remains pertinent and relevant to business purposes, ensuring high sales results and performance, optimizing resources, and concentrating efforts only on segments with the most promising customers. The watchword in this case is "sustainable business": a good ICP = less wasted time, less marketing expenses.

Fifth phase: implementation in the GTM strategy and continuous monitoring

Once the ICP has been identified, validated, and refined, it's essential to implement it in the go-to-market strategy so that all the company's activities aim at the same objectives.

The ways in which a company chooses to reach the buyer personas of its ICP will guide the entire GTM strategy. The messages, marketing campaigns, and channels used to reach customers must take into account the preferences and behaviors expressed in the ICP. Sales approaches and engagement methods must be conceived based on the ICP's buyer personas.

Similarly, product development and evolution must always take into account the needs and problems that the ICP is trying to solve (thanks to the ICP, the company can decide which new features to integrate into the product and which not). The same thing must be done by the entire customer service department which, based on the expectations of the ICP, must guarantee high rates of customer satisfaction and loyalty.

Also in this case, for the work to be alive, dynamic, in line with market changes and customer needs, it must be continuously tested and refined. Only in this way will the ICP be able to guide the company towards achieving effective marketing and sales strategies.

The role of early adopters

In 1962, sociologist Everett M. Rogers published the book "Diffusion of Innovations" introducing the concept of early adopter. In his essay, Rogers describes how innovations are employed in a society, identifying five categories of people based on the speed with which they adopt new ideas or technologies: innovators, early adopters, early majority, late majority, and laggards.

According to this model, early adopters are the group of people who adopt an innovation shortly after the innovators, playing a crucial role in the diffusion of new ideas thanks to their influence and the respect they enjoy in their communities.

In the startup world, the concept of early adopter was popularized by Geoffrey Moore, particularly through his book Crossing the Chasm. Moore adapted and expanded Everett Rogers' theory, applying it specifically to the context of technology startups and high-tech markets.

In Crossing the Chasm, Moore explains how the crucial challenge for new companies is precisely to face the transition from early adopters (the first enthusiastic users willing to risk with new technologies) to the early majority, a wider and more conservative audience. This transition, according to Moore, is the critical point for many startups, and is often where their success or failure is decided.

ECP vs ICP

On the road leading to the ICP, early adopters play a fundamental role. The ICP is not the result of a photograph that immortalizes a single moment. As the case of Norwegian salmon demonstrates, reference targets can vary over time due to unplanned necessities, but the same applies to all those phases that precede the characterization of the ICP.

Before conquering the ICP, you need to make your way in the market to reach it, and this means finding important evidence that can demonstrate how a product/service really works: case studies, testimonials, use cases, working prototypes, etc.

The only path to follow to obtain this evidence is to analyze the behavior of Early Customer Profiles (ECP), that is, the early adopters.

Potentially every ECP could use the product for sale in different ways and for different purposes, it will be the use cases that will have the most success in leading towards the ideal customer. It is therefore crucial to focus on the best ECPs, those that come closest to the future ICP.

Archetypes of early adopters

Author and GTM strategist Maja Voje, thanks to her field experience, has identified 5 different archetypes of early adopters over the years.

Tech enthusiast: technology enthusiasts, those always ready to try new tools and new services providing feedback and testimonials. If the novelty meets their expectations, they will be the first to promote it in various communities, but they get bored quickly if they are not frequently stimulated.

Underdog supporter: early adopters with good intentions, those who always support innovation, especially if sustainable. However, they have a limited budget that is often not sufficient to trigger real change.

Game changer: they are the "rebels of the company", the most creative leaders, those who seek in any way to bring positive changes and optimize a company's processes. They are perfect for obtaining valuable suggestions in favor of the ICP.

Digital transformer: they are often external consultants who are called in at crucial moments for companies that are in a transition phase. Their purpose is to concretely implement the necessary changes for the company to take off, but they can encounter many resistances within the organization. If helped in their mission, they are ready to reciprocate.

Visionary founder: the most charismatic and influential leaders, capable of seeing before everyone else the potential of new products or services. Collaborating with them can open many doors and offer an important testimony, but be careful, because their charisma could distract from the main objective.

The search for and choice of ECPs involves a series of differences compared to the ICP. Customers who can make decisions quickly, with urgent problems to solve and willing to use a product/service that is not entirely perfect are preferred. For this reason, companies are often willing to compromise, offering initial discounts on the sale price. After all, the goal is simple: to obtain as many use cases as possible, therefore many reviews, many feedback, and many testimonials.

Conclusions

As emerged in the episode on Minimum Viable Brand, it is fundamental that the ICP is also clear at all company levels. Not being aligned means aiming at different objectives and therefore slowing down the company's growth itself.

Equally to B2C sales, even in sales between companies, buyer personas find themselves living in increasingly fast contexts full of inputs. For this reason, it becomes fundamental to tighten the target audience as much as possible, at least initially: going for a sure shot is impossible, but the narrower the target, the easier it will be to identify truly interested prospects.

This means having to work very well and with a lot of patience on the research and information gathering part. The refinement phases will be simpler if the work done at the beginning was done well, vice versa there is a risk of spending money and time on wrong targets.

References

Stijn Hendrikse and Mike Northfield, T2D3: How some software startups scale, where many fail (2021, Independently published)

Before there is Ideal, there is Early (Customer Profile), Maja Voje

A Step-by-Step Guide to Creating an Ideal Customer Profile (ICP), Arpit Mishra

How to build the ideal customer profile for your business, Arnie Gullov-Singh

The Decision-Making Unit: The Who-is-Who of Your B2B Sales Process, Disciplined Entrepreneurship