It's all about positioning: the B2B SAAS Positioning Framework

In this new episode, I explain how to design a B2B SAAS product positioning strategy and secure a front-row spot in the minds (and hearts) of consumers.

When I co-founded HYPE with other fellow travelers, one of the first questions I asked myself was: how do we distinguish ourselves from traditional banks? HYPE wasn’t a bank, but the goal was to position itself in people’s minds as an alternative to that world full of bureaucracy, long waits, and many inconveniences.

It was 2014, and so-called online or digital banks already existed, but we were entering a different market: fintech and challenger banks. Additionally, there was a regulatory issue; as I said, HYPE was not technically a bank; it had authorization from the Bank of Italy to conduct banking activities but was not classified as such. The word bank was thus banned; we couldn't say, for example, "Choose HYPE, your new online bank."

Initially, we tried to associate HYPE with the concept of managing money via smartphone; one of the claims was, indeed, "Control your money with your smartphone." It didn’t work; the concept of an app helping people manage money was still unclear to people, and too much information was missing.

We then thought of a possible competitor: registering with HYPE would get a prepaid card and an IBAN payment code. In Italy, Poste set a precedent with Postepay and its prepaid cards, so why not leverage that advantage in our favor? Everyone knew the benefits of prepaid cards, so we would become the “prepaid card with superpowers.” The rest is history; today, HYPE is one of the leading European realities with nearly 2 million customers.

The power of positioning

Working on brand perception and communicating a message that can be easily deciphered based on the prospect's knowledge is defined as “positioning.”

To be successful today, you must touch base with reality. And the only reality that counts is what’s already in the prospect’s mind. [...] The basic positioning approach is not to create something new and different but to manipulate what’s already in the mind to retie the existing connections.

Al Ries and Jack Strout,

Positioning - The Battle For Your Mind

You must be selective and stand out from market competitors to do this. In today's popular term, developing an STP marketing process (segmentation, targeting, and positioning) is important.

The work done with HYPE was exactly this. First, we identified a broad market segment (all people looking for a simpler and faster way to manage their finances compared to a traditional bank), then we selected a specific target (all those people who wanted to do it at zero cost and through more convenient tools), and finally, we positioned the product on that target with ad hoc communication (the prepaid card with superpowers).

Positioning Framework for B2B SAAS Companies

The work phases that determined HYPE’s positioning are valid for any type of company. Over the years, I’ve worked on different B2B ventures, refined the model, and built a clear and precise framework capable of defining a brand's positioning strategy starting from an external context.

The framework is designed with B2B sales models in mind but can be easily adapted to B2C models. The goal is simple: to understand what a company can do better than its competitors.

1. Market Definition

Imagine participating in a treasure hunt: each clue leads you to a new truth, and each truth brings you closer to the treasure. It’s like a concentric figure; there’s a larger circle and many overlapping smaller circles leading to the core.

In the “positioning hunt,” the first truth a company must conquer (the largest circle) is understanding WHERE to start looking for its ideal customer and consequently identifying its reference market.

The puzzle pieces to assemble are different, and the questions to answer are many:

Market Landscape: What type of product does the company sell? Is it unique, or are there other companies selling the same product? Which companies operate in this market? What products do they sell, and how many customers do they have?

Coverage Model: What geographical areas does the company want to operate in? Will it be a local or national business? What sales channels will the company use to ensure coverage of these areas?

Business Potential: What is the maximum volume of sales and revenue a company can aspire to by working in this market?

Industry Trends: What are the main growth drivers within the market, and what are the main obstacles?

Revenue Drivers: What factors drive customers to purchase the product? Are they driven by price? By the product's value? By its innovative potential? By what does it represent?

Competitive Environment: What are the main forms of market competition, and who are the top 3 competitors?

2. Segmentation

After defining the reference market, the next step is to identify the segments with the highest purchasing potential and where we can thrive with our product.

Depending on the sales model, the company will need to refine WHERE its ideal potential customer profile is in the market. So, it is necessary to map the various segments to select the most interesting one.

To map the market segments, it is necessary to understand the different segments specificity:

Industries: What sectors does the company prefer to work with, and which ones does it want to avoid at all costs?

Number of employees: How large will the ICP be? Will it be a small, medium, or large company?

Keyword: Are there keywords that could help the company more precisely target its customers? For example, all B2B companies that do lead generation.

Revenues: How much does the client with whom the company will do business generate?

Location: What is the geographical area where the ICP operates? Does the company prefer to work with clients from specific regions (e.g., for linguistic reasons)?

And understand the segment’s dimensions:

Average order value: What is the typical deal size?

Customer Base: How many customers do you have in your customer base?

Total Available market segment: The number of potential customers and the revenue you could generate.

Acquisition Target: the number of customers you could conquer and the revenue you could generate.

Estimated Market Share: the number of customers you could conquer and the revenue you could generate.

For example, if a startup sells logistics services to e-commerce companies, each segment could be defined based on its size: SMB, mid-market, or large enterprise. The deal size will change with the size of the target companies, and the same goes for the number of potential customers.

This will allow for deriving a potential customer base for each segment and its potential revenues.

3. Targeting (Ideal Customer Profile)

Comparing the main segments that emerged, each company can choose the one that best suits its characteristics and identify its target audience (Ideal Customer Profile). After understanding WHERE to look for potential customers, it’s time to understand WHO these customers are and their main characteristics.

Business Function and Job Titles: Who are the potential beneficiaries of the offer, and in which department do they work?

Each will be grouped based on their role in the purchasing process: who is the end-user (the business figures who will operationally use the product/service sold)? Who is the champion (the department in the company that promotes the benefits of the product/service to be purchased)? Who is the economic buyer (the figures within the company responsible for the budget and the final purchase of the product/service)?

Defining these points will help each company understand the basic characteristics of the customers it wants to attract, focusing efforts in a specific direction from the start and avoiding wasting time on potential customers who are not interested in the offer.

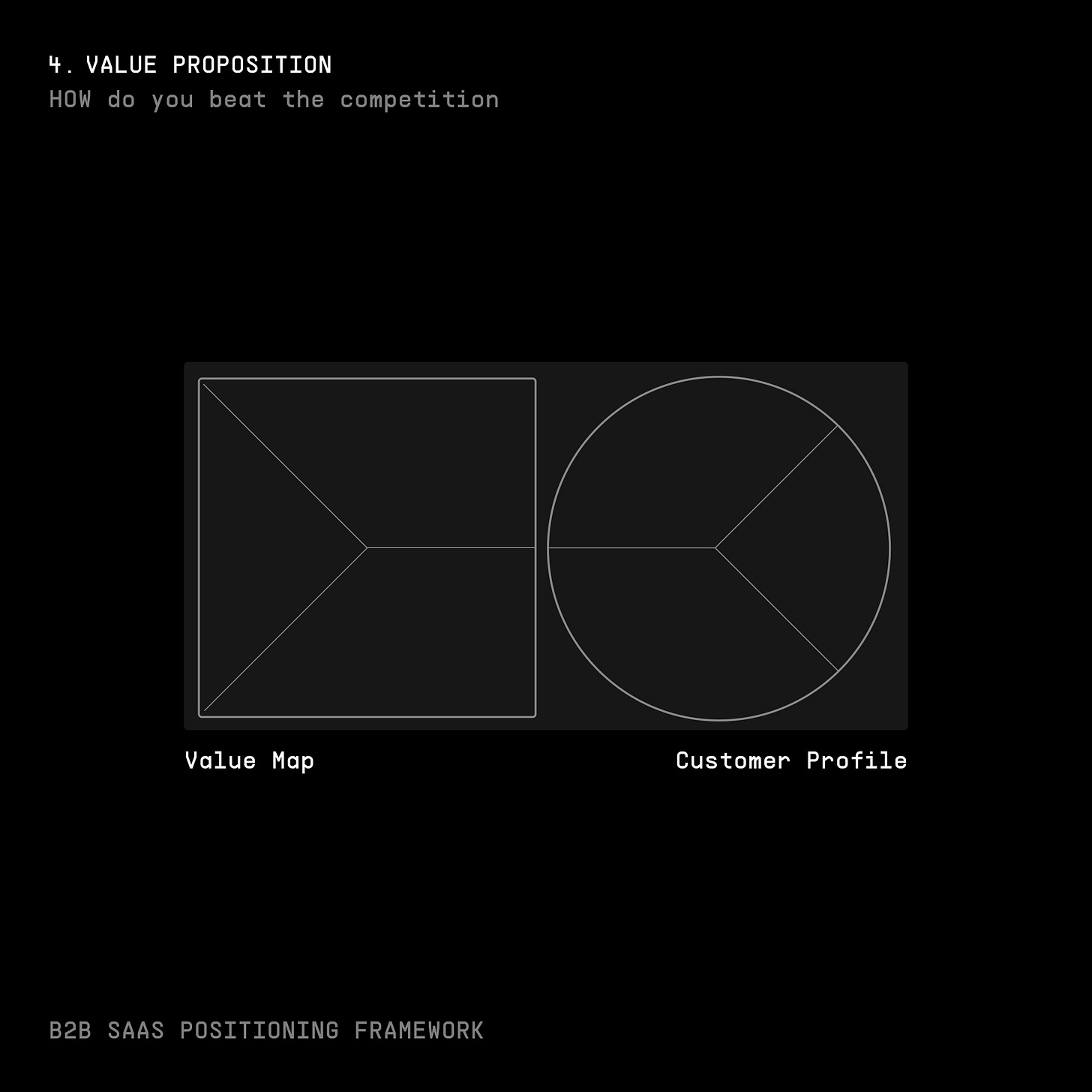

4. Identifying the Value Proposition

Having a clear understanding of WHO your ideal customer profile (ICP) is, it is easier to find WHY they buy through the Value Proposition Canvas.

The model consists of two parts: the Customer Profile and the Value Map.

The Customer Profile should include:

Customer Jobs (JTBD - Jobs To Be Done) the customer is trying to accomplish. These could be business, social, or personal/emotional jobs.

Gains: the benefits and results gained from accomplishing the customer jobs.

Pains: describe anything that annoys your customer before, during, or after trying to get a Customer Job.

The more information gathered about customers, the more valuable and meaningful the data will be for the research.

The Value Map helps us understand WHAT they buy.

Should list the products and services offered (on which the Value Proposition is to be built), how these products and services will help simplify the customer's life, and the benefits the customer will gain from using them.

These are outputs that make the brand compelling, and that must be understood by audiences. Ideally, at least one of these will be unique to the brand.

Comparing the data from the Customer Profile with the expectations of the Value Map will make it possible to eliminate incorrect hypotheses and optimize the Value Proposition. The goal is to balance customer needs and the proposed solutions to meet those needs and solve their problems. This is what the startup scene calls product-market fit or problem-solution fit.

5. Competitive Analysis

Once the Value Proposition is defined, the company can compare it with that of its competitors and understand how to highlight its strengths that could make a difference in the market.

For this reason, the next step in developing a positioning strategy is studying the competition. Where to start? Obviously, from the reference market identified in the first step. This is the arena where the challenge will take place.

There are various ways to define the competition: market research, feedback from already acquired customers, social media analysis (do not underestimate Quora and Reddit, or prospecting platforms like Apollo)

But each sector has its rules: a small-town clothing store might explore Google Maps to find competitors closest to it; an artisan might start their research by touring trade fairs; and a software company might find information using databases like Capterra, G2, or Crunchbase.

This will allow you to immediately have a list of competitors to analyze. For each of them, a vertical research will then be carried out to define:

What products or services do they offer, and what promises are made to prospects

What their strengths and weaknesses are

What their distinctive elements are

What benefits do the distinctive elements bring to customers

What evidence makes the benefits offered credible

For each research project to be successful, it is extremely important to analyze each competitor with utmost impartiality without being sabotaged by potential biases. The analysis will allow the company to obtain the information needed to find a strategy capable of beating the competition.

To understand HOW your product could beat the competition, it is necessary to bundle analyzed data and define:

Competitor Promise: What is the most common promise to your prospect?

Company Premise: What is the commonly held belief your prospect has that does not need to be proven or reinforced?

Unique Attributes: A list of features or attributes that are unique to us.

Value: The benefit the attribute enables for customers

Reason to believe → Proof: Supporting points making the message tangible, evidence-based, and realistic.

It could be very useful to use perceptual mapping to identify areas where competitors left a market gap.

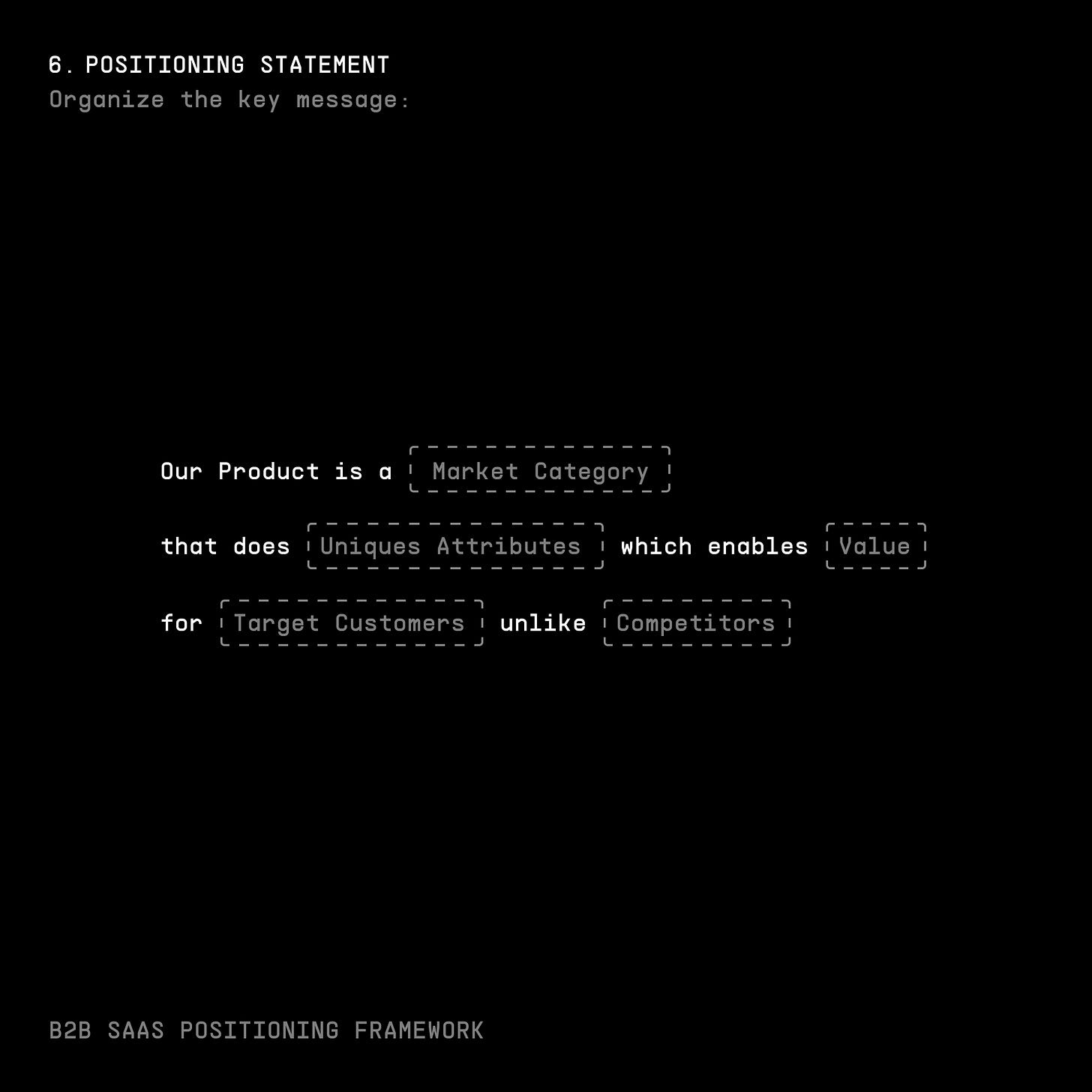

6. Organizing Key Messages

All the information and data collected up to this point will need to be synthesized into a series of key messages, which in turn will need to be tailored according to the recipients (end user, champion, economic buyer) and communication touchpoints.

Organizing the messages helps to have clear ideas about all the steps of the positioning strategy and at the same time guides the company towards defining the Positioning Statement, that is, a first concrete hypothesis of positioning: the one that will serve to position the brand in the minds (and hearts) of the prospects.

If the Value Proposition focuses on the element that differentiates a brand from all its competitors, the Positioning Statement focuses on the primary benefits this offers to its customers and why customers should choose that offer.

The most common exercise to define a statement is to answer the following four questions:

What is the target audience?

To which market category does the product/service offered belong?

What is the greatest benefit obtained by using the product/service offered?

What is the proof of that benefit?

This exercise is often proposed in the form of a simplified diagram:

An effective Positioning Statement should not be longer than 25 words. In addition to this, the following messages should be defined: the brand's tagline, the elevator pitch, the list of distinctive elements of the brand and its products, the list of the main benefits for consumers, and the reason to believe.

Mistakes to Avoid

Arriving at defining a brand’s positioning and tracing a strategy to keep it alive and consistent across all communication touchpoints hides several pitfalls.

One of the most frequent mistakes is getting stuck on studying competitors and their offers. To the question "What would customers use if your brand did not exist?" there is not necessarily an answer. Or rather, the answer might be "Nothing!". The existence of a market void is positive, and positioning oneself first in the minds of prospects concerning a new product is a huge advantage.

Another mistake related to competition is identifying as competitors companies that are not actually competitors, the so-called imaginary enemies. Even if, on paper, a company might compete with us, it might not necessarily be so. Focusing resources on studying these competitors is not only a waste of time but might also lead the company down the wrong path in defining its positioning.

The third mistake concerns the definition of the market. Many startups are indeed convinced that to achieve success (more easily and quickly), it is necessary to create a new market category. Again, not only is there a risk of wasting a lot of time, but also of missing the target: it is much easier to position oneself in an already existing category. The opposite entails a laborious task of communication to explain to people the market in which they operate, the usefulness of the products, and, of course, the perception of the benefits derived from their use.

Conclusions

The use of artificial intelligence could favor the development of increasingly standardized and uniform markets, with fewer poetic licenses and a number of products and services very similar to each other. The same thing could occur in the way brands choose to communicate these products in the market.

Fortunately, the final choice always rests with the customer, based on their needs (old and new), the benefits they wish to achieve, and the difficulties they want to overcome. Working on the perception that the customer has of the brand will therefore remain fundamental and indeed, will make the work on positioning even more decisive for the success or failure of a product.

References:

Al Ries and Jack Strout, Positioning - The Battle For Your Mind (McGraw-Hill, 2001)

Guide to Segmentation, Targeting & Positioning (STP) + Examples (pulsarplatform.com)

Value Proposition Canvas – Download the Official Template (strategyzer.com)

Brand Positioning Guide for Contract Manufacturers (equinetmedia.com)

A quickstart guide to positioning - by Lenny Rachitsky (lennysnewsletter.com)